The Payment Card Industry Data Security Standard (PCI DSS)

Our company has been honored with awards for excellence, innovation, and outstanding business achievements.

Payment Card Industry Data Security Standard (PCI DSS) in Singapore

PCI-DSS (Payment Card Industry Data Security Standard) is a globally recognized framework designed to safeguard cardholder information across all payment channels. By adhering to PCI-DSS (Payment Card Industry Data Security Standard), organizations ensure the secure storage, processing, and transmission of sensitive payment data, significantly reducing the risk of fraud and data breaches. This makes PCI-DSS (Payment Card Industry Data Security Standard) essential for businesses that handle credit or debit card transactions, as it helps maintain customer trust and regulatory compliance. Implementing PCI-DSS (Payment Card Industry Data Security Standard) not only strengthens an organization’s cybersecurity posture but also enhances its reputation for prioritizing data protection.

Why is PCI-DSS Compliance Important?

- Prevents Data Breaches – Strengthens security measures to safeguard sensitive payment information.

- Builds Customer Trust – Enhances credibility by demonstrating a commitment to data protection.

- Mandatory for Businesses – Required for any company handling credit or debit card transactions.

- Avoids Penalties & Fines – Non-compliance can result in hefty financial penalties and reputational damage.

Achieving PCI-DSS certification is essential for businesses accepting card payments, ensuring compliance with industry regulations while protecting financial data and maintaining customer confidence.

KEY ASPECTS of PCI-DSS COMPLIANCE

- Secure Network Configurations – Prevents unauthorized access and data leaks.

- Access Controls & Monitoring – Ensures only authorized personnel handle sensitive data.

- Data Encryption – Protects cardholder information during storage and transmission.

- Regulatory Compliance – Avoids penalties and ensures adherence to industry standards.

Why Achieve PCI-DSS Certification?

PCI-DSS (Payment Card Industry Data Security Standard) certification is essential for any organization that stores, processes, or transmits credit and debit card information. Achieving compliance demonstrates that your business follows strict security standards to protect cardholder data.

Key Reasons to Get PCI-DSS Certified

Protect Customer Payment Data

Ensures sensitive cardholder information is securely managed, reducing the risk of data breaches and fraud.Build Customer Confidence

Boosts trust among customers, partners, and stakeholders by showing you take data security seriously.Comply with Global Payment Standards

Required by major card brands (Visa, Mastercard, AmEx, etc.) and financial institutions.Avoid Costly Fines & Penalties

Non-compliance can result in hefty penalties, legal liabilities, and reputational damage.Enhance Business Reputation

PCI-DSS certification is a mark of credibility and security assurance in the payments industry.Strengthen Security Posture

Encourages implementation of best practices in IT, risk management, and operational security.

STREGENTHENING PAYMENT SECURITY FOR BUSINESS'

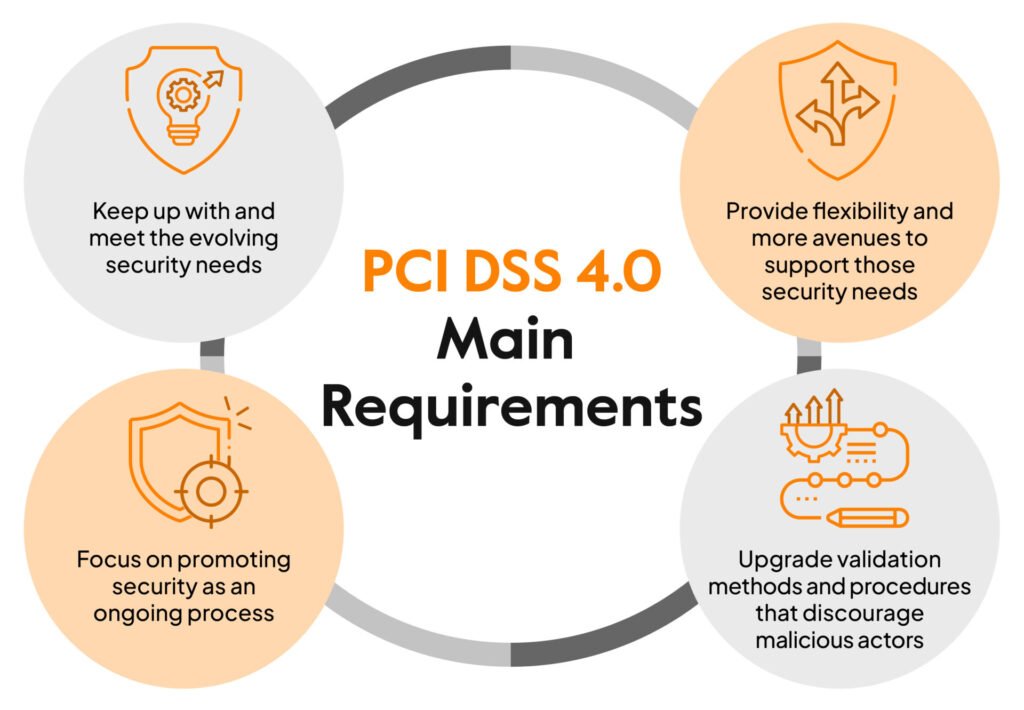

PCI-DSS v4.0 is the latest security standard designed to protect payment card data and prevent fraud. With enhanced security controls and improved compliance measures, it helps businesses safeguard transactions in an evolving digital landscape. Understanding its updates and the PCI Self-Assessment Questionnaire (SAQ) is essential for ensuring compliance and maintaining secure payment systems.

PCI-DSS v4.0

PCI-DSS v4.0 is the latest security standard ensuring businesses securely process, store, and transmit payment card data. It strengthens authentication, encryption, and monitoring to protect against fraud and cyber threats.

PCI-DSS v4.0

This update introduces stronger security controls, continuous compliance validation, and better protection for modern payment methods like cloud, mobile, and e-commerce. It helps businesses stay ahead of evolving threats.

PCI-SAQ

The PCI Self-Assessment Questionnaire (SAQ) helps businesses check their compliance without a full audit. Choosing the right SAQ ensures secure transactions, protects cardholder data, and avoids penalties.

PCI-DSS Compliance Levels

PCI-DSS (Payment Card Industry Data Security Standard) compliance is divided into four levels, based on the volume of card transactions processed annually. These levels determine the specific requirements an organization must follow to remain compliant.

Level 1

This level applies to merchants processing over six million card transactions annually. They must undergo an assessment by an authorized PCI auditor and complete an internal audit every year. Additionally, businesses are required to perform quarterly PCI scans by an Approved Scanning Vendor (ASV).

Level 2

Merchants processing between one million and six million transactions must complete an annual Self-Assessment Questionnaire (SAQ). Depending on the business, a quarterly PCI scan may also be necessary to ensure compliance with the PCI-DSS requirements.

Level 3

This level applies to businesses handling 20,000 to 1 million e-commerce transactions annually. These merchants are required to submit a yearly assessment via the appropriate SAQ and quarterly PCI scans to verify that security measures are in place.

Level 4

Level 4 merchants process fewer than 20,000 e-commerce transactions annually or fewer than one million real-world card transactions. They must also complete an annual SAQ and may be required to undergo quarterly PCI scans.